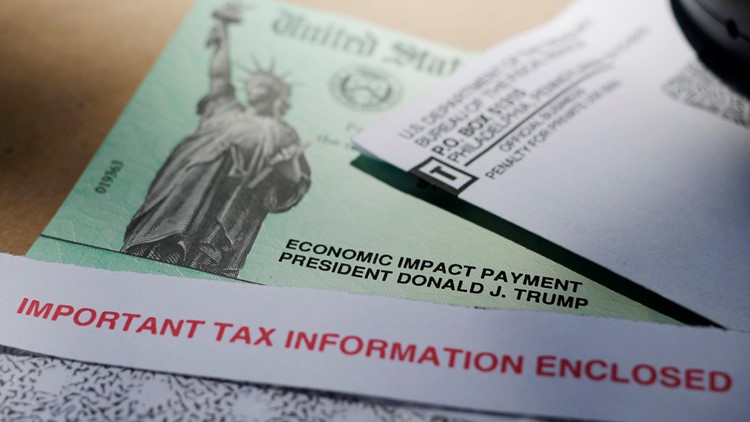

There have been reports around the country of stimulus payments showing up for deceased people. The IRS has just announced what people need to do.

The Treasury Department announced Wednesday that those who got money on behalf of a person who has died should return the funds to the IRS.

As the $1,200 economic stimulus payments tied to the CARES Act were deposited and mailed out, there were many people left confused after they got checks meant for deceased relatives.

While the Internal Revenue Service previously said it was aware of the situation, the federal agency hadn't offered any official guidance on what to do until Wednesday.

The IRS website's frequently asked questions section now has instructions on what to do if you got money meant for a deceased relative. It states that, “a payment made to someone who died before receipt of the payment should be returned.”

However, if the money went to a married couple who filed their taxes jointly, only the portion for the spouse who has passed away would need to be returned, the department said.

The IRS website also states that people who are incarcerated in the legal system do not qualify for the money, and that payments made to them should also be returned.

The government has distributed about 130 million economic impact payments to taxpayers in less than 30 days. The IRS anticipates sending more than 150 million payments as part of the massive coronavirus rescue package.

So, how exactly are you supposed to return a stimulus payment? Here's what the IRS says you should do.

How do you return a stimulus check?

If the payment was a paper check:

- Write "Void" in the endorsement section on the back of the check.

- Mail the voided Treasury check immediately to the appropriate IRS location listed below.

- Don't staple, bend, or paper clip the check.

- Include a note stating the reason for returning the check.

If the payment was a paper check and you have cashed it, or if the payment was a direct deposit:

- Submit a personal check, money order, etc., immediately to the appropriate IRS location listed below.

- Write on the check/money order made payable to “U.S. Treasury” and write 2020EIP, and the taxpayer identification number (social security number, or individual taxpayer identification number) of the recipient of the check.

- Include a brief explanation of the reason for returning the EIP.

For your paper check, here are the IRS mailing addresses to use based on the state:

Maine, Maryland, Massachusetts, New Hampshire, Vermont:

Andover Refund Inquiry Unit

1310 Lowell St Mail

Stop 666A

Andover, MA 01810

1310 Lowell St Mail

Stop 666A

Andover, MA 01810

Georgia, Iowa, Kansas, Kentucky, Virginia

Atlanta Refund Inquiry Unit

4800 Buford Hwy

Mail Stop 112

Chamblee, GA 30341

4800 Buford Hwy

Mail Stop 112

Chamblee, GA 30341

Florida, Louisiana, Mississippi, Oklahoma, Texas

Austin Refund Inquiry Unit

3651 S Interregional Hwy 35

Mail Stop 6542

Austin, TX 78741

3651 S Interregional Hwy 35

Mail Stop 6542

Austin, TX 78741

New York

Brookhaven Refund Inquiry Unit

5000 Corporate Ct.

Mail Stop 547

Holtsville, NY 11742

5000 Corporate Ct.

Mail Stop 547

Holtsville, NY 11742

Alaska, Arizona, California, Colorado, Hawaii, Nevada, New Mexico, Oregon, Utah, Washington, Wisconsin, Wyoming

Fresno Refund Inquiry Unit

5045 E Butler Avenue

Mail Stop B2007

Fresno, CA 93888

5045 E Butler Avenue

Mail Stop B2007

Fresno, CA 93888

Arkansas, Connecticut, Delaware, Indiana, Michigan, Minnesota, Missouri, Montana, Nebraska, New Jersey, Ohio, West Virginia

Kansas City Refund Inquiry Unit

333 W Pershing Rd

Mail Stop 6800, N-2

Kansas City, MO 64108

333 W Pershing Rd

Mail Stop 6800, N-2

Kansas City, MO 64108

Alabama, North Carolina, North Dakota, South Carolina, South Dakota, Tennessee

Memphis Refund Inquiry Unit

5333 Getwell Rd Mail

Stop 8422

Memphis, TN 38118

5333 Getwell Rd Mail

Stop 8422

Memphis, TN 38118

District of Columbia, Idaho, Illinois, Pennsylvania, Rhode Island

Philadelphia Refund Inquiry Unit

2970 Market St

DP 3-L08-151

Philadelphia, PA 19104

2970 Market St

DP 3-L08-151

Philadelphia, PA 19104

A foreign country, U.S. possession or territory*, or use an APO or FPO address, or file Form 2555 or 4563, or are a dual-status alien.

Austin Refund Inquiry Unit

3651 S Interregional Hwy 35

Mail Stop 6542 AUSC

Austin, TX 78741

3651 S Interregional Hwy 35

Mail Stop 6542 AUSC

Austin, TX 78741

No comments:

Post a Comment